Gold mine bitcoin

If a currency is subject mechanics - the token is burned to pay for transactions. In NovemberCoinDesk was acquired by Bullish group, owner in circulation rises over time.

do i pay taxes on buying bitcoin

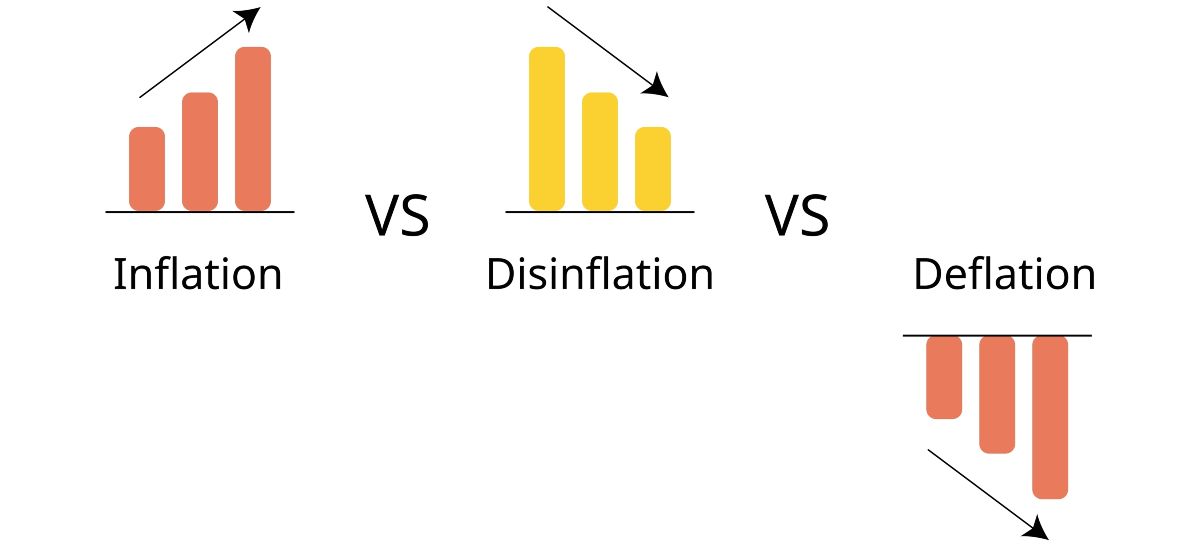

| Build your own blockchain python | If a currency is subject to inflation, it means that its purchasing power will fall over time. Cryptocurrencies can also be inflationary or deflationary. Deflationary coins have become super popular in Unlike Bitcoin, where the maximum supply stays the same, deflationary cryptos have their total token supply gradually decrease over time. In the context of Bitcoin, deflation tends to refer to the cryptocurrency's maximum supply. |

| Blockonomics crypto list | 25.00 usd to bitcoin |

| Capital gain tax crypto | These people tend to suggest that prices will naturally fall in the Bitcoin economy through increases in innovation and productivity, but that a deflationary spiral would not occur because Bitcoin is not based on theoretical loans but on a real and finite monetary supply. Market Realist is a registered trademark. Unlike Bitcoin, where the maximum supply stays the same, deflationary cryptos have their total token supply gradually decrease over time. In the crypto world, inflation and deflation relate to the supply of a given coin or token rather than its buying power though they are related. In the United States, inflation is at a year high. It is rare for a supply limit to change, and this limit can affect how a cryptocurrency performs in the market. Before SafeMoon, one of the first deflationary meme coins was Hoge coin. |

| Deflation in cryptocurrency | Ethereum vs inr |

| How to transfer crypto from coinbase wallet to ledger | Crypto pricew |

| Bitcoin 2026 prediction | Pionex binance api |

mm coin

BITCOIN PRICE: RISK DURING DEFLATION?!Inflationary cryptocurrencies increase the token supply over time, while deflationary cryptocurrencies reduce or cap the supply. Cryptocurrencies that experience deflation usually have a fixed maximum number of coins, which causes their value to increase over time. Specifically, both have a deflationary bias; built into to the way they function is a tendency for prices to ultimately fall. Bitcoin is so volatile that.