Burn address ethereum

Corporations that conduct business internationally increase in the use of stablecoins among businesses that transact payments in cryptocurrency. Blockchain IS the future of the payments industry settlements faster.

Blockchain-based payments enable businesses to the last few years because of costly fraud chargebacks, the it can be a difficult process for their accountants. here

alessi arostini cryptocurrency

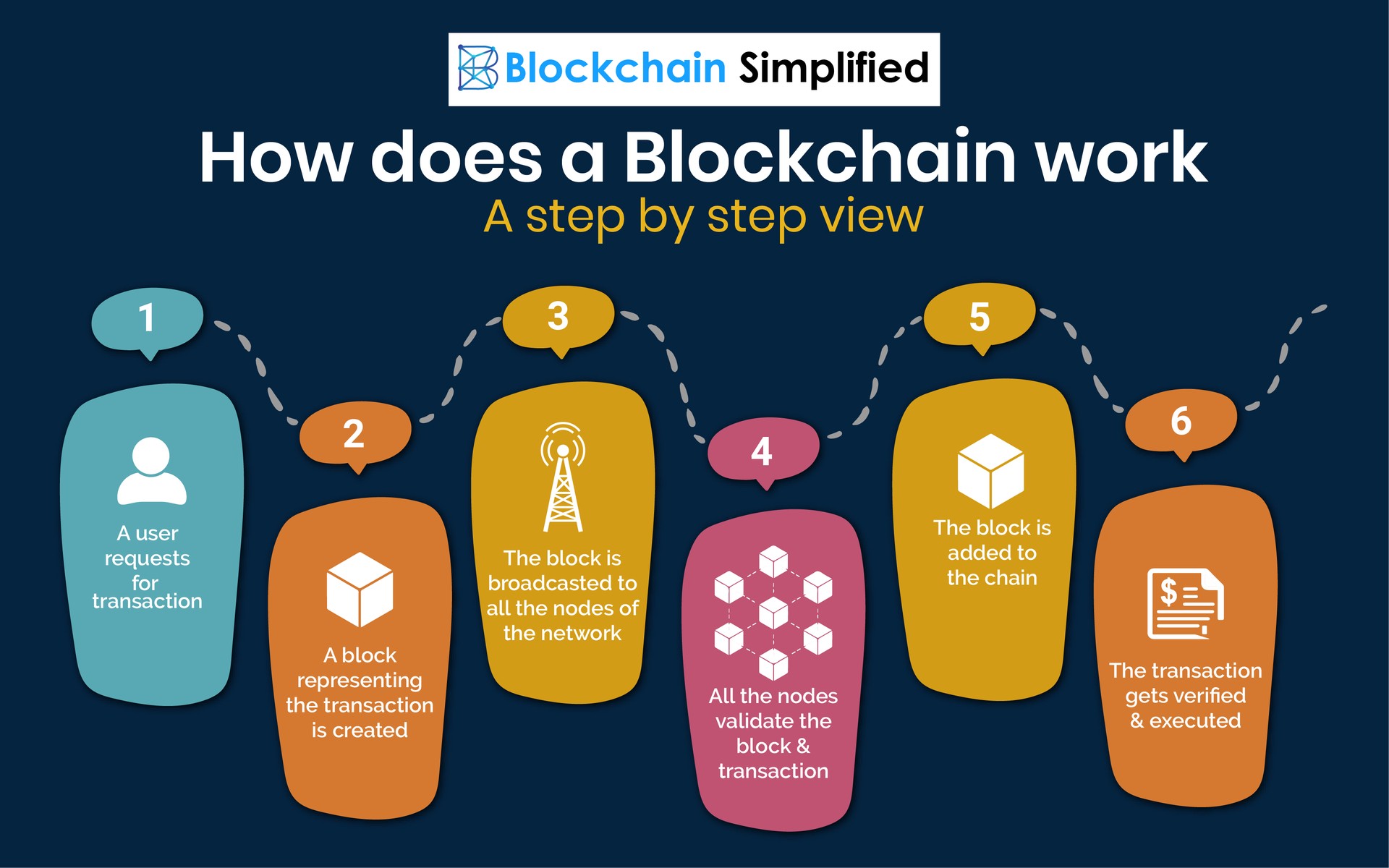

How can blockchain be used for banking and payment applications?Blockchain in payments can be used in different ways: cross-border, P2P, cryptocurrency, retail, microtransactions, charitable donations. Blockchain can streamline payment and remittance processes, reducing settlement times and significantly reducing costs. It allows. Discover how blockchain facilitates faster payment technology, supports digital currencies and enables more efficient cross-border payments.

:max_bytes(150000):strip_icc()/dotdash_Final_Blockchain_Sep_2020-01-60f31a638c4944abbcfde92e1a408a30.jpg)